There is no excerpt because this is a protected post.

Author Archives: BFC

My institution wants to offer to our (existing or future) customers a new service. Do we need a partner?

We don’t believe that there is a hard and fast answer to this question. Below we provide a simple YES/NO question guide which you may follow:

Serbian MSMEs and the Challenges of COVID-19

The COVID-19 pandemic has had a global impact, leaving both mature markets and emerging economies struggling. Some of the hardest hit have been micro-, small- and medium-sized enterprises (MSMEs). This is of particular note for Serbia’s economy as MSMEs represent 99% of active business entities, generate over 30% of GDP, contributing to 40% of total …

Continue reading “Serbian MSMEs and the Challenges of COVID-19”

Series – II – What are the next steps for entrepreneurs?

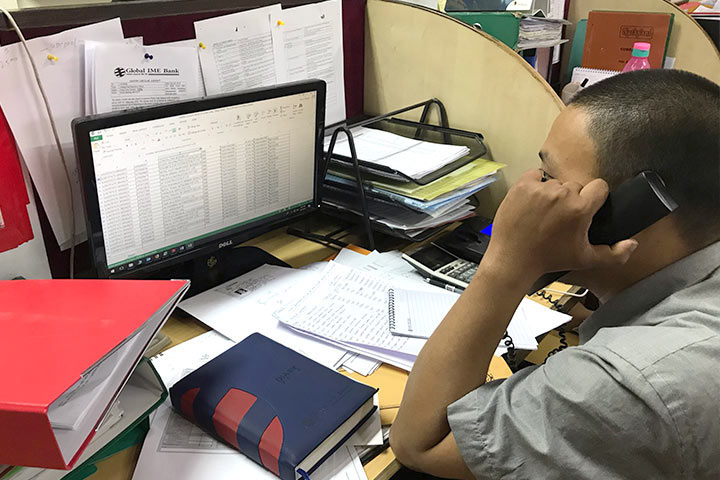

May 2020 • Subrina Shrestha, MSME and Agri Finance Consultant (BFC, Nepal) This article is the second part of the article published in April 2020 which was accompanied by a short survey. A total of 35 respondents were interviewed to obtain a general overview of the entrepreneurs’ perception and actions expected to be taken due …

Continue reading “Series – II – What are the next steps for entrepreneurs?”

AskBFC: How does the business increase the efficiency of branch staff during lock-down and post lock-down periods

May 2020 • Yurii Voychak, MSME and Agrilending Consultant (BFC, Nepal) During the quarantine period, many banks sent their staff on compulsory leave, some banks began to think even about reducing number of staff in the branches in order to optimize costs in the context of the economic crisis. Each bank, of course, has its …

AskBFC: During the loan restructuring process when considering different groups of clients should individual or package approaches be made

May 2020 • Yurii Voychak, MSME and Agrilending Consultant (BFC, Nepal) I would say that all banks in Nepal are actually in the same situation so this question is relevant for all Risk Managers who are working on loan portfolio analysis and restructuring strategies that can be implemented. It is understandable that banks do not …

AskBFC: During the post lock-down period, will centralized or decentralized decision making in the credit process be beneficial

May 2020 • Gayrat Mazbutov, Bank Coordinator/MSME & Agrilending Consultant (BFC, Nepal) In light of the upcoming crisis period typically accompanied by growing credit risk and assets quality deterioration, we strongly recommend switching to centralized decision making to ensure more accurate and objective approach. A solution widely practiced worldwide in developed and developing countries not …

What are the Challenges for Nepali SMEs Amidst COVID-19 Crisis

April 2020 • Subrina Shrestha, MSME and Agri Finance Consultant (BFC, Nepal) Are there any silver linings emerging? What can SMEs do next? Scenario of SMEs during COVID-19 in Nepal At the start of 2020 Nepal’s government was optimistic of attaining the targeted GDP growth of 8.5% in FY 2019/2020. The promotion of Visit …

Continue reading “What are the Challenges for Nepali SMEs Amidst COVID-19 Crisis”

How automation and digitization increased productivity by 25% at Banca Intesa Serbia

Learn how a leading Serbian bank more than halved loan processing and approval times thanks to BFC’s MasterAPS loan origination system. Automation and digitization have invaded nearly every aspect of our lives—from the way we buy products to the way we interact with friends and family. This is especially true in the banking sector. Consumers …

Trends in Agricultural Finance at the European Microfinance Week 2016

Michael Kortenbusch, Managing Director of Business & Finance Consulting (BFC), hosted a panel discussion on the trends in agricultural finance on November 17, 2016 as part of European Microfinance Week. Mr. Kortenbusch invited Ms. Mariel Mensink, Mr. Bart de Bruyne, Dr. Jonathan Agwe, and Ms. Patricia Richter to each give a brief presentation followed by …

Continue reading “Trends in Agricultural Finance at the European Microfinance Week 2016”