Series – II – What are the next steps for entrepreneurs?

May 2020 • Subrina Shrestha, MSME and Agri Finance Consultant (BFC, Nepal)

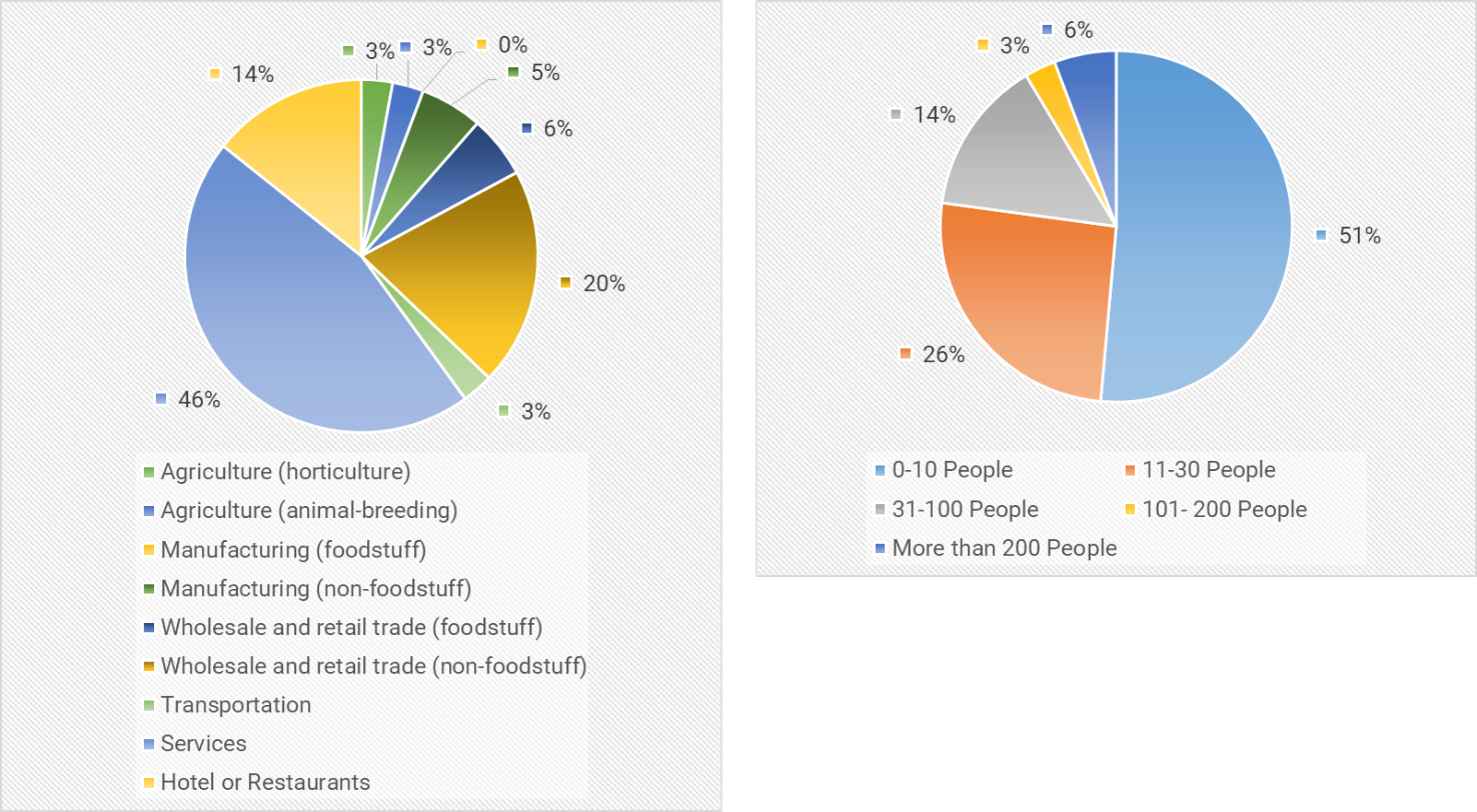

This article is the second part of the article published in April 2020 which was accompanied by a short survey. A total of 35 respondents were interviewed to obtain a general overview of the entrepreneurs’ perception and actions expected to be taken due to the COVID-19 crisis.

In Nepal, the elongated lockdown measure has resulted in a general environment of increased discomfort among businesses, and a restlessness among citizens evident by increased cases of people being held for defying the lockdown orders. The gradual (phased) lifting of the lockdown is bound to happen sooner than later. And when that happens, it won’t be back to business as usual. Revenue rebound for most businesses is expected to be slow, while cost continues to pile up and venturing into the unknown post COVID economy will compel businesses to take harsh steps.

Insights from the Survey

Recovery Mode On

The principal action for businesses will be to change gears from panic mode to recovery mode. It will be important to understand the damage done in terms of key numbers – cash flow, cost of cancelled contracts, etc. without being swayed by the negative bias around survival of businesses in a post Covid economy. The level of impact on businesses will be different depending on the sector and also on how the business model was or will be pivoted to adjust to the challenges of Covid. Stories of how perishable agri-goods are rotting in the fields are abundant amidst this crisis while on the other hand a few organized agri-based companies such as Mato, AgriMove, and Kheti are advertising their ability to supply fresh fruits and vegetables in Kathmandu. Flexibility and innovation in the way of doing business will allow smart entrepreneurs to prevail.

Staff Management and Pay Revisions

During the time of crisis, the decisions taken by businesses are bound to be scrutinized by the public. But the harsh reality is that businesses, in order to remain afloat, have to take strategic decisions that may result in layoffs and pay cuts. Adopting a lean management structure would be key to remaining effective during this time, and also providing an opportunity to consider innovative ways to manage staff would be beneficial.

Our survey showed that the top three actions that were forced to be taken due to the quarantine restriction, were 1) reducing employees’ wage/salary, 2) decreasing the scale of business and 3) reducing numbers of staff. It is imperative that if businesses decide to scale down, a number of current positions will be unnecessary or unaffordable resulting in further staff cuts. The current widely adopted option of reducing salaries also has to be strategic, as a flat percentage salary cut could be a risky proposition when compared to an earning bracket wise percentage cut (bottom-up approach) which ensures a basic survival income for lower earning staff members. While pay cuts may be unavoidable, businesses also need to strategize on how to retain and motivate staff. Options such as short-term sabbatical leave, and deferred payments (accumulated hours to be claimed during regular working days) may also be explored. The downward pay revision also needs to be revised upward as and when the situation improves, failure to do so could result in the company losing important human resources.

Coping with demand slump

There was an overall agreement among respondents that both domestic and foreign demand will drop, with the expectation of delay in the delivery of product/services to continue. The recovery, post Covid, is expected to be slow (U-shaped recovery), compared to the recovery witnessed post-Earthquake of 2015. A prolonged slump in demand will push the survivability of businesses, and more so for those with low cash reserves. While pivoting the business model should be a key emphasis for businesses, some trends may turn out to be temporary and businesses should not be swayed by the short-term trends fuelled by the crisis. It is key to analyze which behavior is likely to be a sustained behavioral change among customers and employees.

“Since we are in the travel industry, the entire year of 2020 doesn’t look good for us. People may not be willing to travel immediately even if the COVID situation improves”

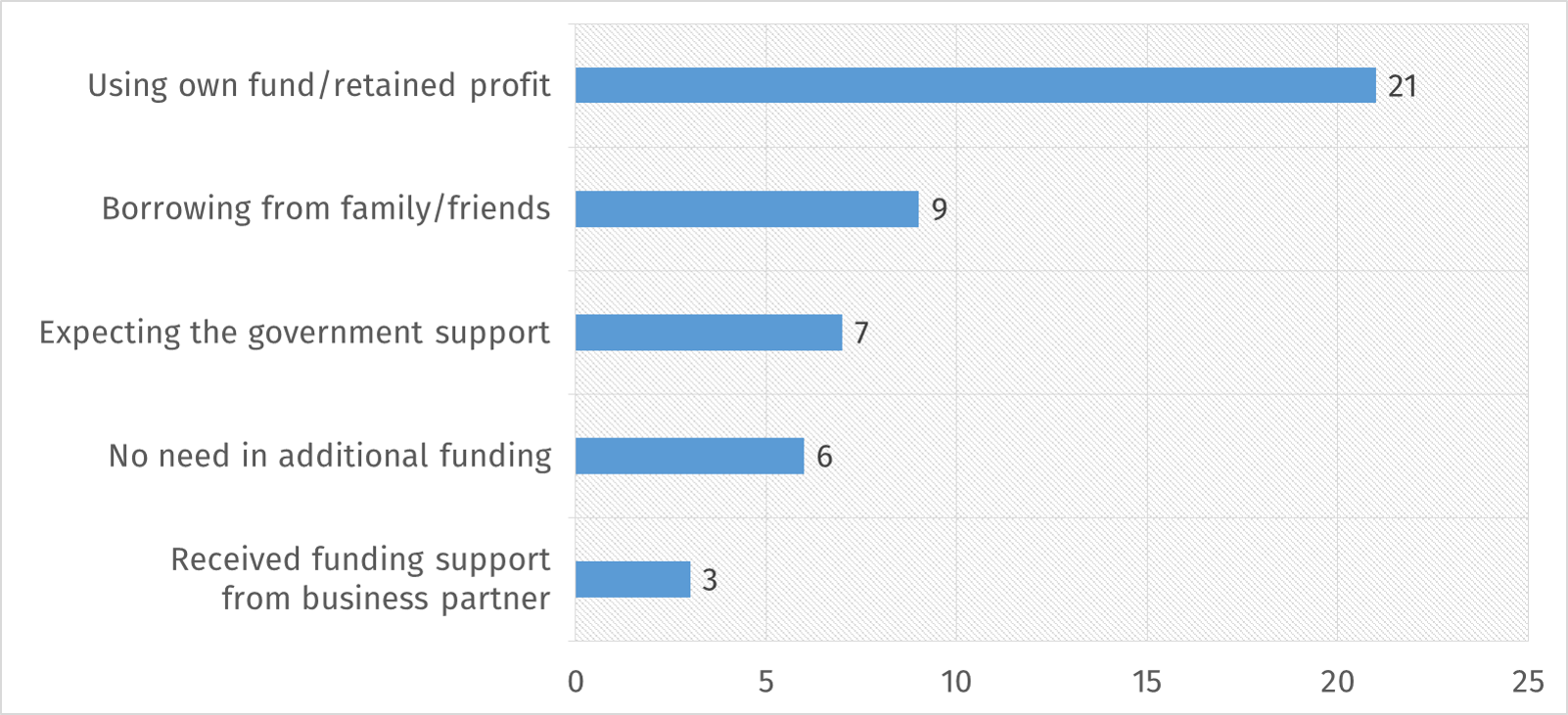

Stimulus package/relief programs

The government so far has only introduced relief packages for businesses in the form of interest rate discounts and tax payment date deferral. Our survey showed that, even in the time of crisis, the majority of the respondents (60%) preferred to use their own fund/retained profit to maintain their business, this preference was reported in combination with borrowing from family, friends and relatives (25.7%) and funding support from business partners (8.6%). Hesitation to take bank financing appears to be persistent in crisis situations. This, however, should not come as a surprise as the NRB survey on SMEs had shown that only 16% of SMEs finance their initial capital through bank loans. It is key to note that 20% of respondents are expecting support from the government to weather this crisis.

Top 5 funding conditions preferred by businesses during COVID crisis (multiple choice)

It is clear that the current support, in terms of interest rate, is likely to cover only a fraction of businesses and in some cases could be more of a missed chance for businesses with prudent financial management, high cash reserve cushion and low bank loan exposure. Looking at the programs introduced by other governments such as the US’s Small Business COVID-19 Emergency Loan, the Indian government’s scheme of tax breaks for small businesses and incentives for domestic manufacturing, etc. could be a good source of information on what the government can do and lessons on what the issues are, as well as, challenges in implementation. So the government could leverage on some second-mover advantage on this. There is no doubt that Nepal’s economy will need its own tailored relief package to address the concerns of the economy while not forgetting about the small enterprises ranging from agriculture to manufacturing.

“Our goods are stranded at the custom points since the last three months, leading to diminishing value of inventory and increased costs”

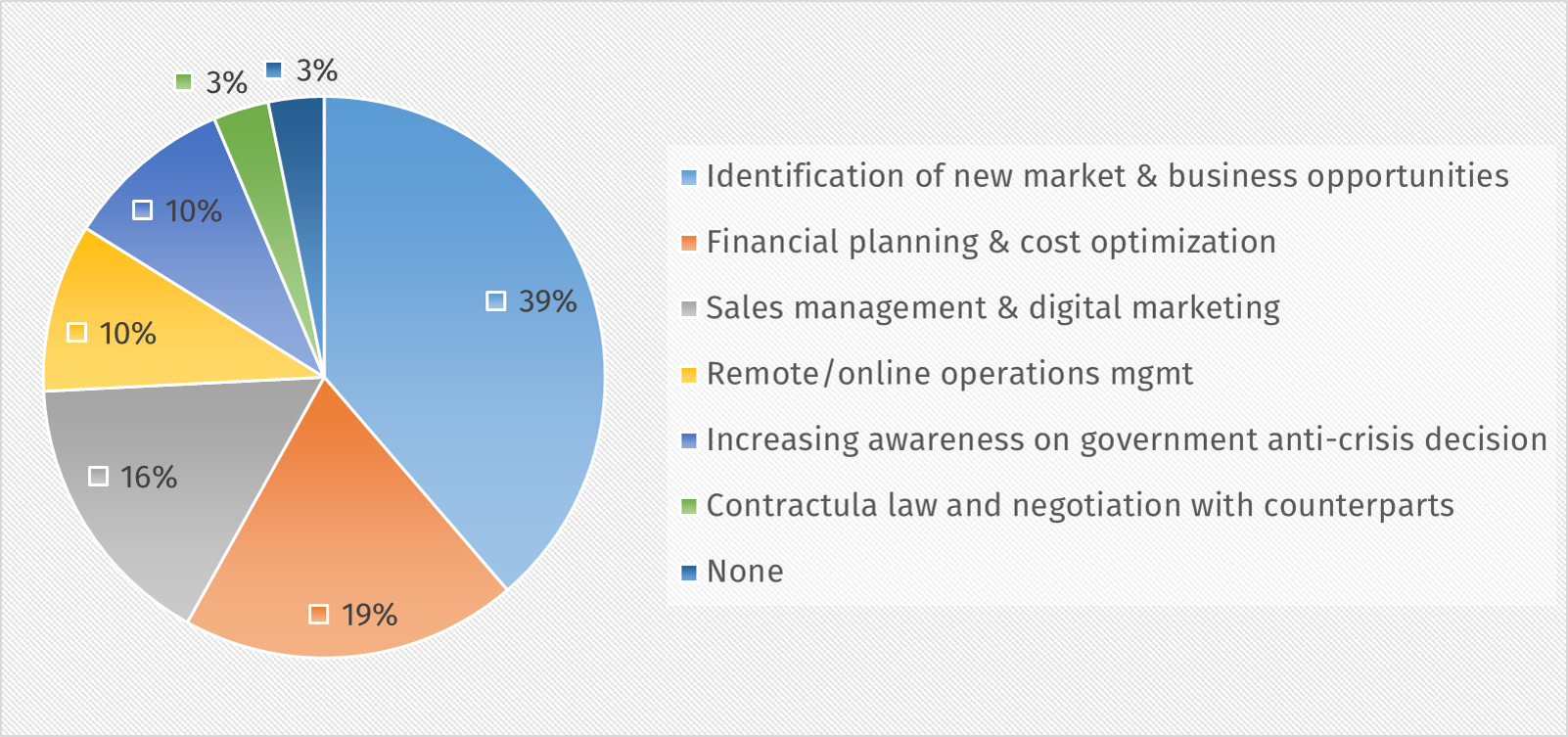

Capacity Building Support

In order to sustain the crisis and ensure survival of the business, entrepreneurs also seek non-financial intervention in the form of capacity building activities. Our survey has shown that entrepreneurs are also looking for capacity building interventions with the top three identified areas being – Identification of new market & business opportunity, Financial Planning & Cost Optimization, and Sales Management & Digital Marketing. Donor funded projects could take this opportunity to devise training and activities around capacity building to enhance the capacity of entrepreneurs to weather the crisis.

Capacity building intervention sought by entrepreneurs

“Every industry still seems to be unknown about the daily consumption of their respective produce”

In a time of crisis it is easy to fail to see any positivity and lose sight of the bigger picture. It is not the time to make panic decisions but to concentrate on innovation and survival. There are no experts on this uncertainty and entrepreneurs all over are rapidly pivoting and innovating to sustain business. Entrepreneurs have to also actively advocate on the support that they require and voice their opinion as the government is also overwhelmed managing the crisis.

BFC in the implementation of KfW funded Sustainable Economic Development in Rural Areas in Nepal (SEDRA) has been providing capacity building trainings to MSMEs and agri-entrepreneurs. Covering areas such as Financial Literacy and Business Management, SEDRA upskilled the staff of its partner company Shreenagar Agro Farm and provided the required training toolkit, enabling them to continue with training activities even after the end of the project. Similarly, with the identification of lack of information as a key issue, SEDRA also supported its partner banks (Global IME Bank and NMB Bank) in Nepal to develop Good Agriculture Practices leaflets and capacity building toolkits for commercial farmers. In the current scenario, BFC has started a COVID-19 response package within which BFC’s team of banking experts provide free webinars on Crisis Response and answer queries from practicing bankers in its Ask BFC Q&A series.