BFC in Nepal

Sustainable Economic Development in Rural and Semi-Urban Areas in Nepal

The project’s main objective, over a 30-month period, is to strengthen the partner banks (PBs) in their capacities to expand their business in urban and rural/agricultural MSME lending in a sustainable and socially responsible manner as well as provide support to agricultural and rural MSMEs in improving their financial literacy and business management skills and enhance productivity through implementation of good agricultural practices.

Equipped with a team of international and local consultants, in 2021 BFC commenced building relationships with the two SEDRA partner banks — Siddhartha Bank and Muktinath Bikas Bank and project stakeholders on the ground.

SEDRA II Objectives

The objective of the SEDRA project is the sustainable provision and use of a target-group oriented loan portfolio for business investments of predominantly rural and semi-urban MSMEs in Nepal. The technical assistance shall contribute to achieving the project objectives.

The technical assistance is targeted at three beneficiaries: PFIs, MSMEs, and NRB.

The objective of the technical assistance targeted:

- At the PFIs is to enable them to successfully implement the project and sustainably serve the rural and semi-urban MSME segment, especially also in light of the COVID -19 crisis;

- At the MSMEs is to enable them to plan and manage their business successfully in financial Terms;

- At NRB is to enable them to set up and sustainably manage the revolving fund and selectively advise them in regulatory aspects of relevance to the project.

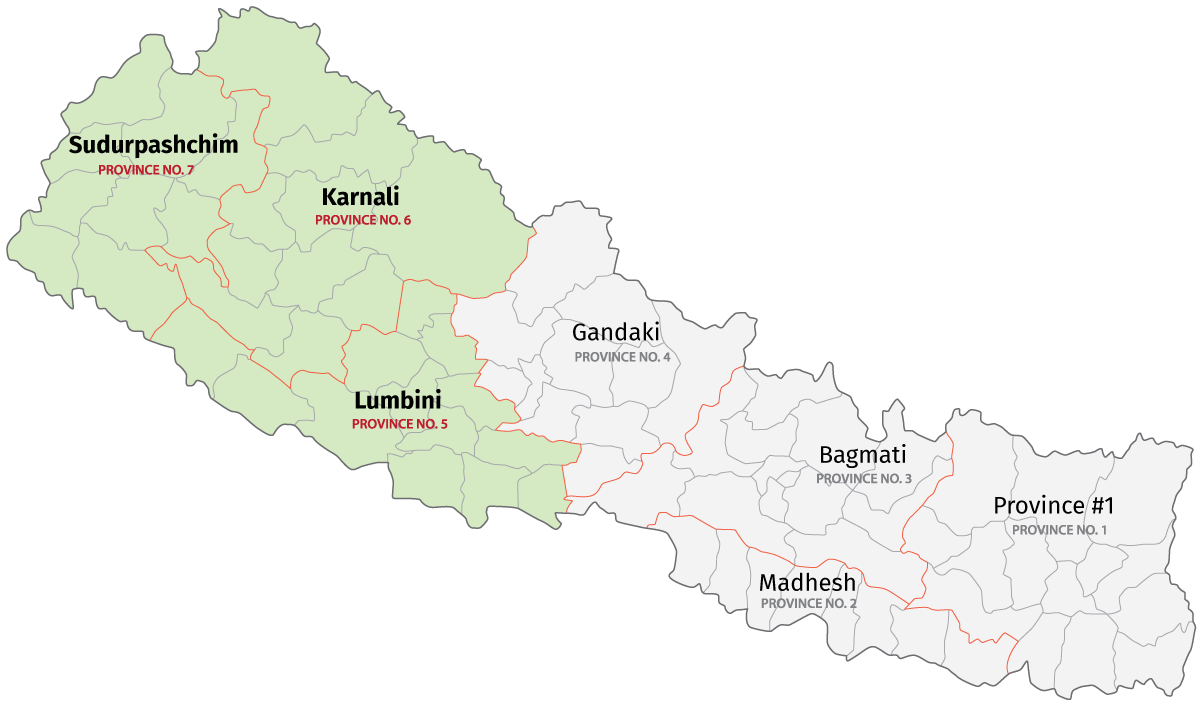

Regional Coverage

Under SEDRA, we also directly worked with entrepreneurs and businesses to improve their capacity to manage businesses and become eligible for bank finance. SEDRA has worked across all the provinces of Nepal, however, our funding activities have been focused in Province 5, 6, and 7.

In addition to this the team traveled across different provinces of Nepal and interacted with numerous agri entrepreneurs to understand their limitations and areas where they would require capacity building interventions. The team has also visited numerous branches and outlets of the partner banks in the aforementioned provinces while fulfilling its mission as the program consultant.

Muktinath Bikas Bank

At Muktinath Bank implementation activities started in 2021 and will continue till 2023 and centered around the following areas:

- Credit process optimization, efficiency and credit risk management

- Review and Improvement of Credit Scoring model

- Implementation of environmental and social risk management system

- Piloting of Alternative Credit Analysis Methodology for MSMEs

- Product Line Improvements

- Strengthening Loan Origination Software of the Bank

- Sales and services quality standards (SSQS), sales enhancement

Technical assistance to Muktinath Bank is expected to be completed by 2023.

Siddhartha Bank

At Siddhartha Bank implementation activities started in 2021 and will continue till 2023 and centered around the following areas:

- Credit process optimization, efficiency and credit risk management

- Piloting of Alternative Credit Analysis Methodology for MSMEs

- Development of Collateral Free Loans

- Review and Improvement of Credit Scoring model

- Sales enhancement and centralized sales management

- Formulation and implementation of Environmental and social risk management

- Product Line Improvement

- Customer capacity building / non-financial service

- Branchless Bnaking Analysis and Improvements

- Strengthening Loan Origination Software of the Bank

- Sales and services quality standards (SSQS), sales enhancement

Technical assistance to Siddhartha Bank is expected to be completed by 2023.

BFC NEPAL STORIES

BFC always makes sure to make each employee happy and accepted. Whether by welcoming international consultants to the branch office in the respective country’s welcoming way or by always making sure they have some informal meetings over a coffee break and team-building activities as well. They make sure to have team-building activities allowing employees from different cultures to learn from each other and express their differences and learn from each other creating a strong cultural bond that helps in building employees' happiness and productivity at work.

BFC always makes sure to organize events as a team building process from time to time so as to make employees engaging whether it be a BBQ party at the BFC office in Nepal or celebrating a BFC team member's birthday or the BFC team going out for a dinner.

Successful Completion of SEDRA Phase II

The closure sessions for the successful completion of SEDRA Phase II took place in August 2023. Throughout the 30-month technical assistance project in partnership with Muktinath Bikas Bank Ltd (MNBBL) and Siddhartha Bank Ltd (SBL), BFC delivered a number of customized solutions. These included a relatively new credit analysis methodology for Nepal, collateral-free loan products, centralized credit underwriting, sales management tools, a digital data-driven reporting model, and more. These solutions helped the partner banks enhance their business processes and data management, ultimately improving the value proposition and customer journey for their rural MSME clients. The results achieved would not have been possible without the consistent dedication, effort, and time invested by the partner teams.