How automation and digitization increased productivity by 25% at Banca Intesa Serbia

Learn how a leading Serbian bank more than halved loan processing and approval times thanks to BFC’s MasterAPS loan origination system.

Automation and digitization have invaded nearly every aspect of our lives—from the way we buy products to the way we interact with friends and family. This is especially true in the banking sector. Consumers have come to expect modern products that are provided to them simply, quickly and cheaply. And they don’t care how or why it works the way it does; they just care that they are provided with world-class products and services. As such, transformation is crucial to sustainability and profitability in the sector.

For financial institutions, balancing the demands of consumers with the requirements of regulators and the innovations of competitors presents a myriad of challenges. At the core, however, one thing has become clear: sustained profitability in the banking sector requires the automation and digitization of lending processes.

The Project at Banca Intesa Serbia

Banca Intesa Serbia is a leading bank in the Serbian market, having the largest share of total assets (15.8% as of Q2 2018). Banca Intesa Serbia is also a top-three bank in lending to Serbian registered household farms.

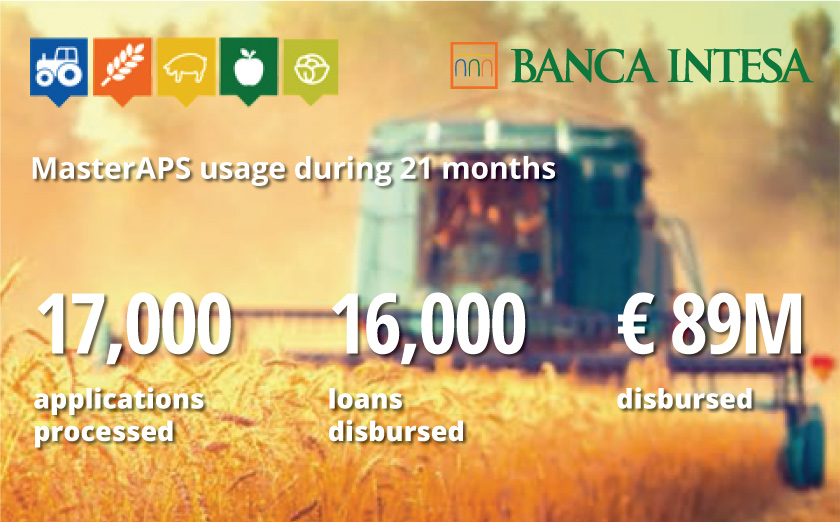

This stark reality was at the center of Banca Intesa Serbia’s decision in April 2017 to maintain its leading position by implementing an automated loan origination system for the processing of agricultural loan applications. The bank accomplished this by taking advantage of technical assistance offered through the KfW Development of Financial System in Rural Areas in Serbia project (2015–2017) to install a customized version of the MasterAPS loan origination system (a unique loan processing system developed by the experts of Swiss-based Business & Finance Consulting (BFC)).

BFC experts met with representatives from Banca Intesa Serbia to determine the exact specifications the bank needed to increase the efficiency of agricultural loan processing and front office staff productivity. BFC then designed unique agricultural technical cards for the bank as well as a completely new loan evaluation process for agricultural loans. These new tools were then integrated into the core MasterAPS processing system built by BFC. At the same, BFC also forged new data integration possibilities for Banca Intesa Serbia by connecting MasterAPS with internal and external data sources (e.g. credit reporting bureaus and the bank’s existing database).

The Impact

![[Chart] Total Processing Time in Days](https://bfconsulting.com/wp-content/uploads/2019/09/MAPS-STAT-processing_.png)

After 9 months of using the new system, Banca Intesa Serbia has observed an almost 30% reduction in agricultural loan processing time as well as a 17% increase in the number of loans distributed to farmers. Moreover, the bank has been able to add information from more than 6,700 clients into a new comprehensive digital database through the use of MasterAPS. This success spurred the bank to take further action in 2018 by:

- Credit process streamlining

- Reducing the number of credit processing roles

- Updating job descriptions for some roles

- Implementing rule-based decision-making models

- Partially decentralizing decision-making

- Revising the organizational structure of the Agricultural Lending Department

- Expanding to service medium- and large-sized farmers in Novi Sad

By taking these further credit process improvement actions, the bank had hoped to reduce processing time by 50%. The cumulative effect of MasterAPS on lending operations at Banca Intesa Serbia, however, far exceeded the bank’s expectations.

With BFC’s APS we have optimized our decision-making process, reshaping it and easily moving from a fully centralized model to semi-centralized. After implementing BFC’s APS within our standard decision-making process, we managed to reduce processing time by 30%. With partial decentralization of the process through BFC’s APS we expect to reduce it by 50%.

(September 24, 2018)

Beyond Expectations

As of the end of 2018 (as compared to pre-MasterAPS figures in 2016), the implementation of MasterAPS has resulted in:

- 54% reduction in processing time (time to cash)

- 64% reduction in time to yes

- 63% increase in lending volume (i.e. total lending amount)

- 27% increase in number of loans disbursed

- 26% increase in number of household farm clients

- 6% increase in client retention

- 31% increase in outstanding portfolio amount

For BFC, the positive results and feedback from Banca Intesa Serbia are the most valuable KPIs, demonstrating the value of BFC’s efforts to support digital transformation in emerging markets as ways to further engage the financial sector in MSME, agricultural and retail lending. Perhaps most importantly for BFC, the success of their efforts with Banca Intesa Serbia shows that automation and digitization are the modern way of increasing access to financing and extending important services to all.

BFC’s APS, with its variety of built-in and customized reports, provides us effective control over sales force results and efficiency, operational activities, and decision-making statistics. Moreover, we are now in a position to collect and store all financial and non-financial data for a challenging client group. A huge and valuable database was already collected within one year of using BFC’s APS.

(September 24, 2018)

This case at Banca Intesa Serbia shows that automation and digitization are not just “nice-to-haves”; they are, in fact, “must haves” that have a proven track record within the financial sector. In the end, being a market leader means being at the forefront of innovation and constantly striving for service and process improvements. BFC understands this and is fully-supportive of Banca Intesa Serbia’s efforts in this direction. In the end, Banca Intesa Serbia, thanks to a fruitful collaboration with BFC and the implementation of BFC’s MasterAPS, has now positioned itself as one of the leading financial institutions supporting agriculture financing in Serbia.

To learn more about MasterAPS, click here.