Empowering People

TRANSFORMATION

Who we are

We are a management consulting company. We build client-centric, data-driven, and innovative solutions.

What we do

We offer financial consultancy to banks and microfinance institutions in emerging markets.

Why we do it

We strive to allow both the institutions we work with and their clients to flourish.

Featured

Refugee Finance in times of uncertainty: mitigating risks and identifying opportunities

Session One: Direct Impacts on Neighboring Countries

Season Two: Indirect Impact on MSMEs and Financial Service Providers

News & Publications

BFC’s Agricultural Bulletins

Monthly publications that present a condensed roundup of events related the agricultural sectors.FinTech Weekly Bulletins

BFC’s FinTech Bulletin is a weekly publication that explores the hottest topics and trends in FinTech.

Digital Finance Tech Handbook

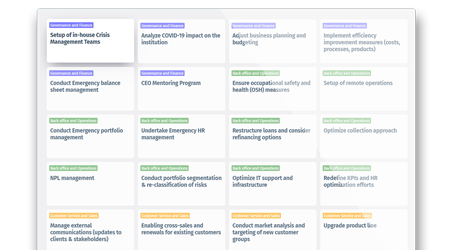

Digital transformation has become even more important. Learn from BFC how to be successful.BFC COVID-19 Response

Banking Expertise

Agricultural / Rural Finance

Agricultural and rural development are essential for most emerging economies. BFC works closely with lenders to ensure adequate financing is available for this sector to develop.

Green Finance

With a growing global awareness of the effects of climate change on the planet, the need for green finance has become more prominent. BFC is committed to supporting those who want to develop in an environmentally responsible way.

SME Finance

SME financial needs require a greater degree of flexibility on the part of lenders. BFC works to develop comprehensive and flexible product packages tailored to suit each client group’s financial needs.

Microfinance

Microfinance allows any individual or microbusiness that lacks access to conventional banking, the ability to gain affordable financial services. BFC has extensive experience in helping lenders support this significant sector.

Consulting Services

Market Research

In-depth and informative analytical insights that respond to your needs and help take your organisation to the next level

Diagnostics and Due Diligence

Comprehensive internal assessments that allow businesses to take decisive and informed actions

Operational Development

Personalised tools that are designed to give the greatest impact and highlight opportunities to maximise success

Product Solutions

Digital Transformation

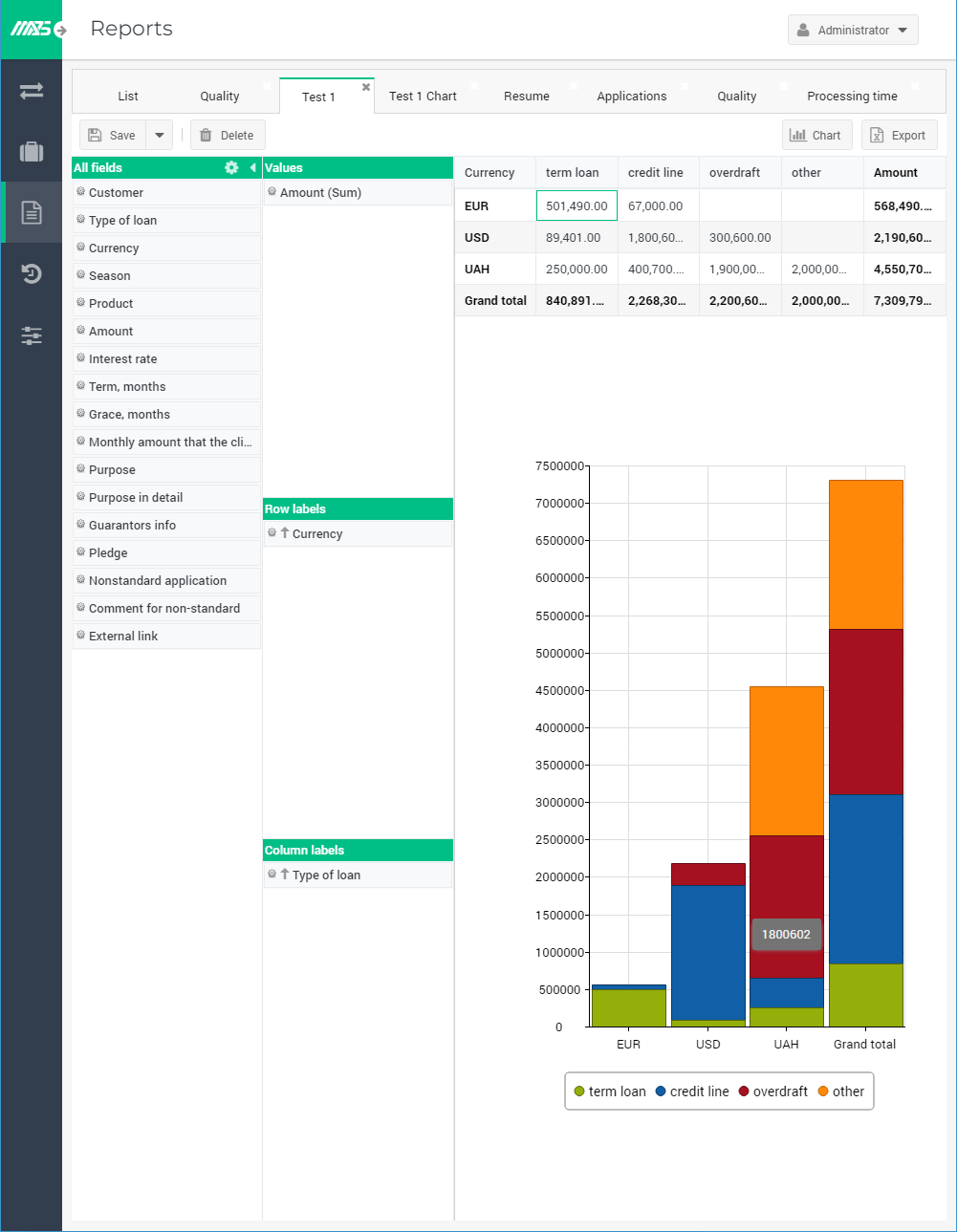

Drive the future of finance with modern, data-driven digital solutions that power the core of your operations

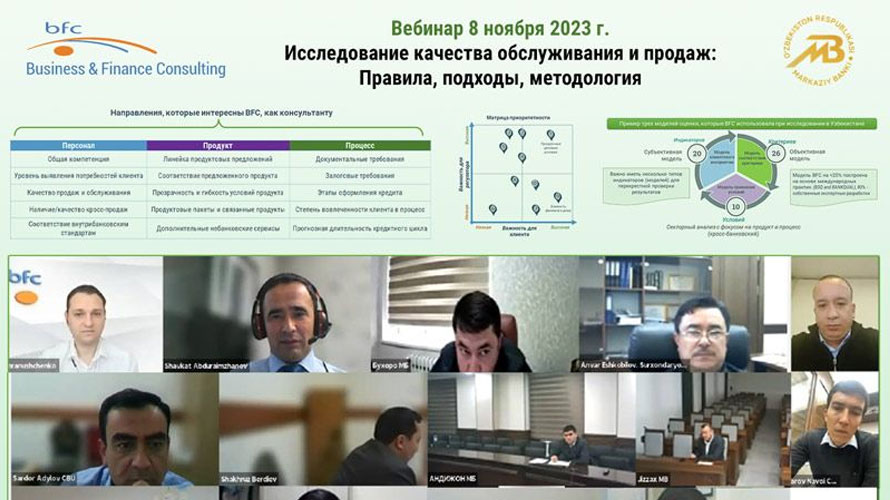

Knowledge Sharing

Empower yourself with the knowledge to set yourself apart from competitors

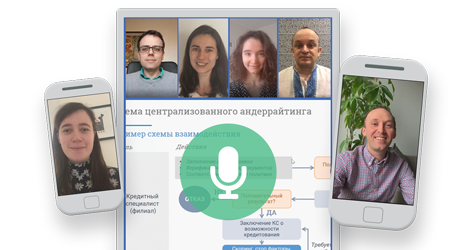

Credit Process

Enhance the quality of your services to become a recognised market leader

Digital Solution

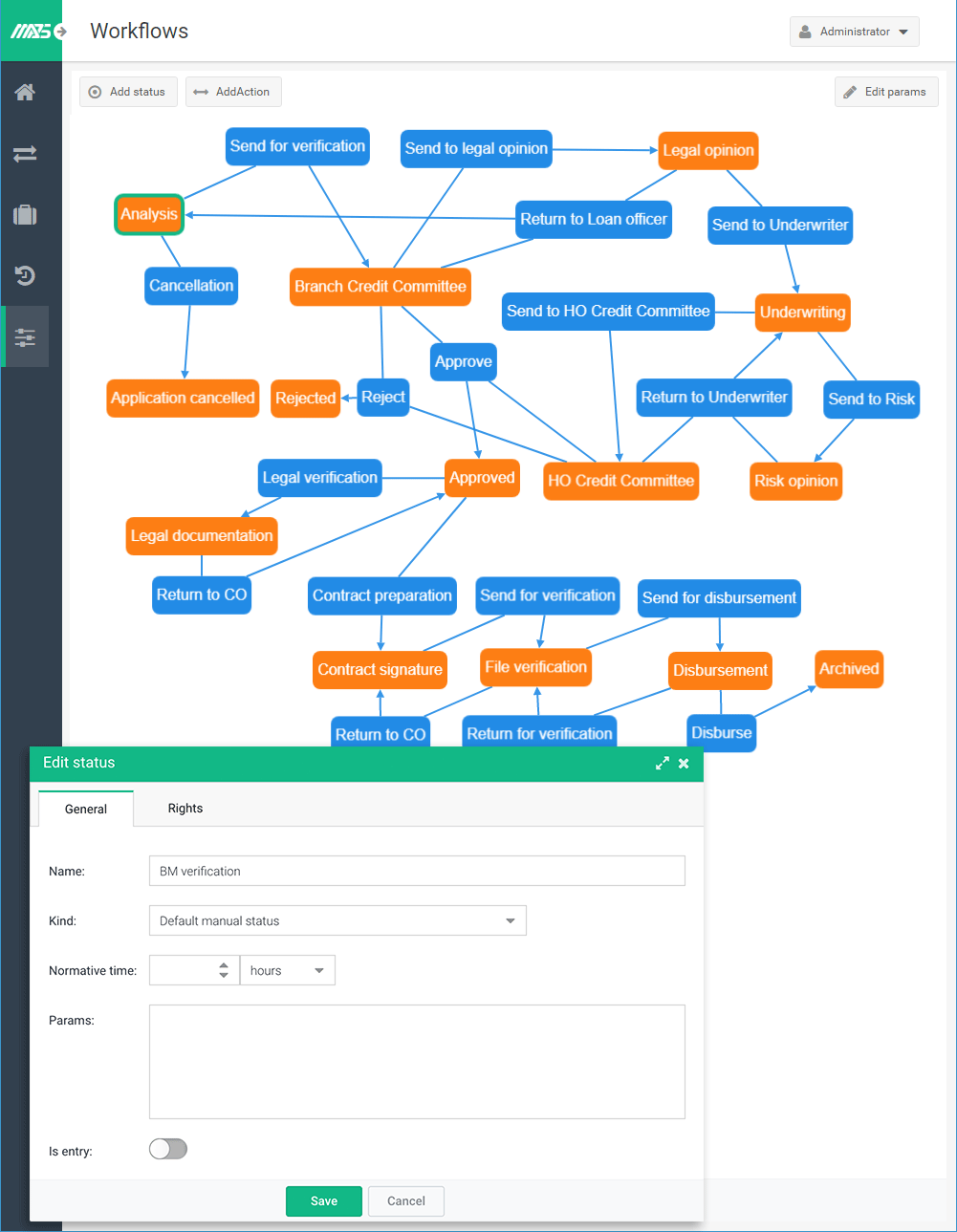

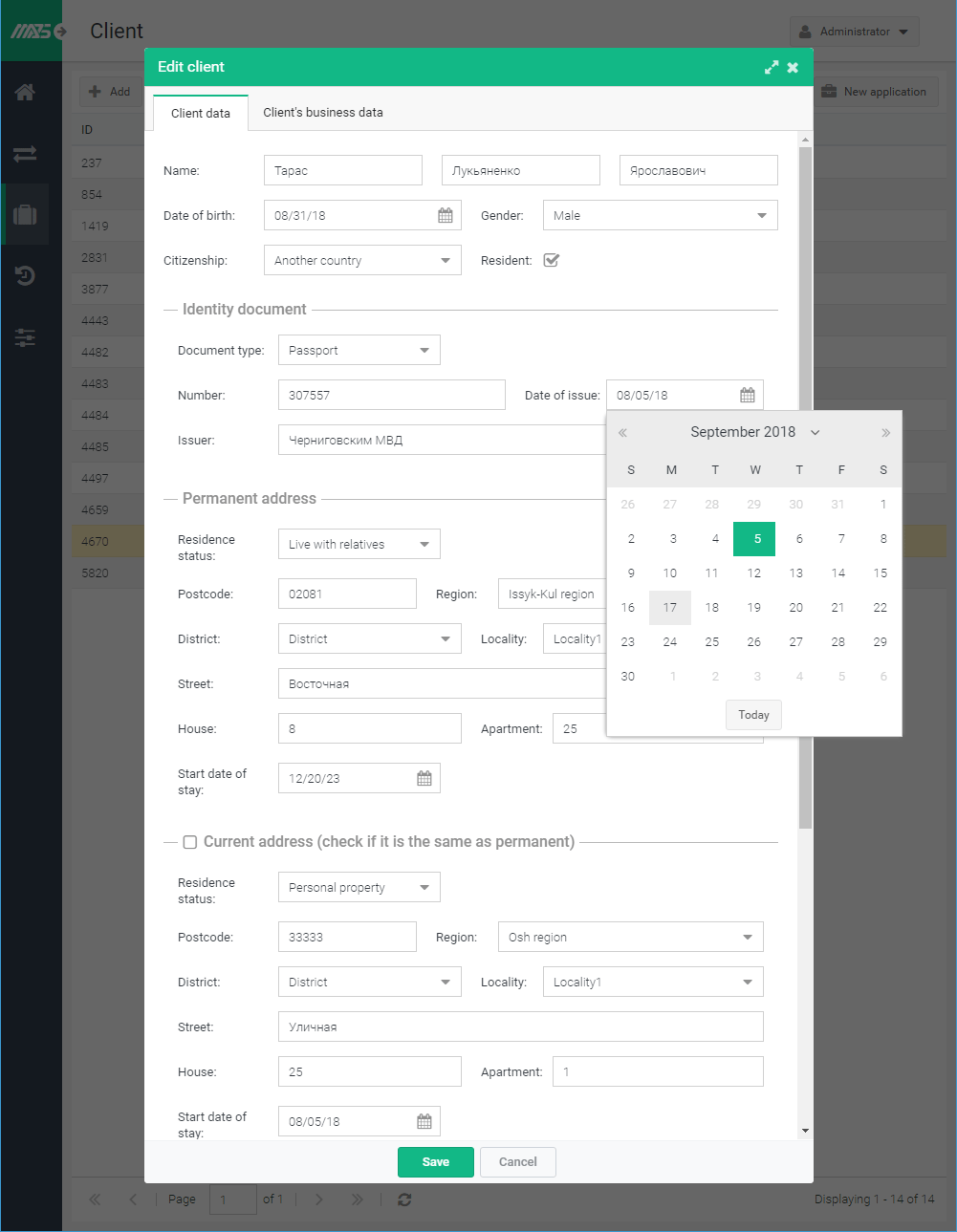

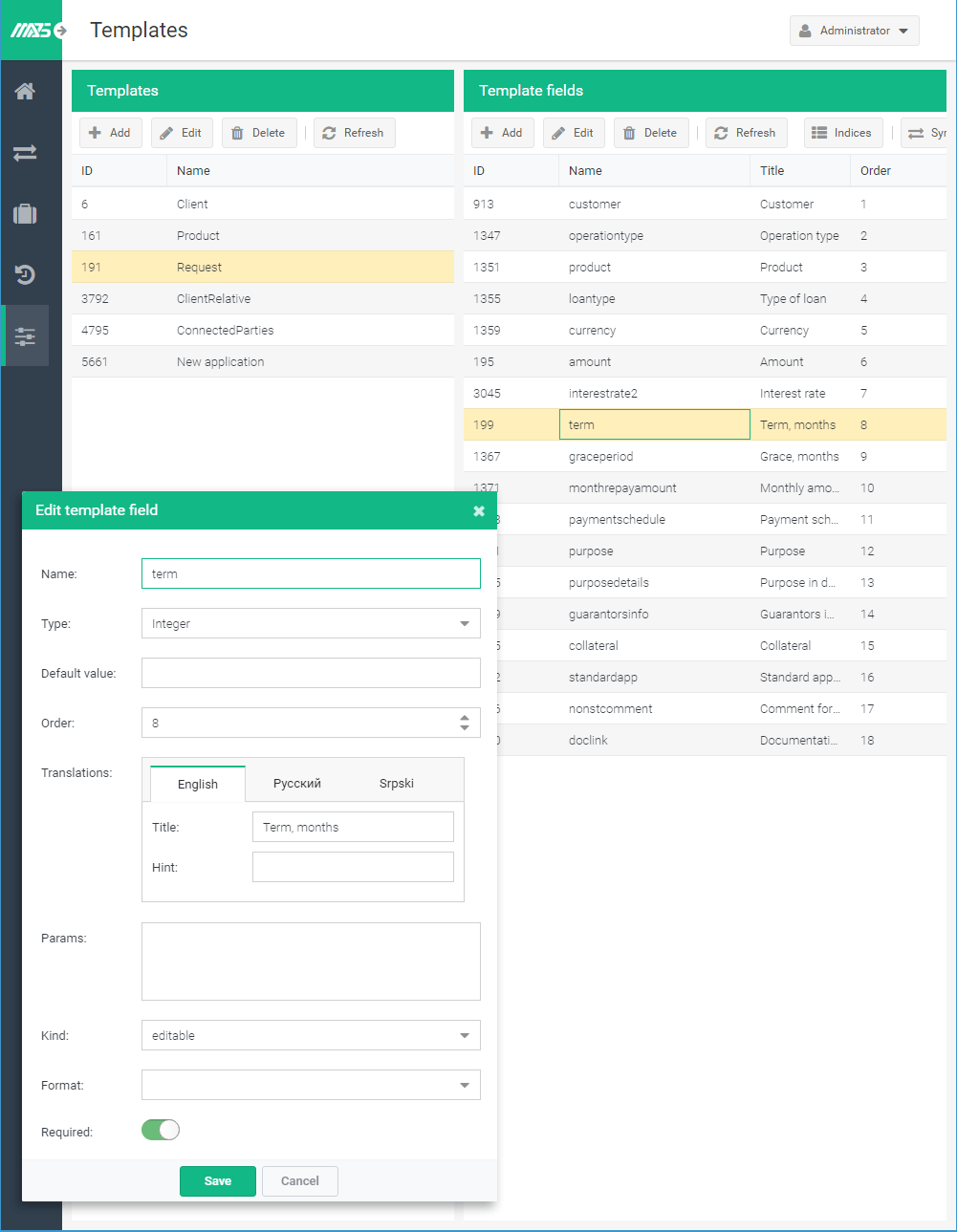

MasterAPS

MasterAPS is a secure Application Processing System (APS) that is fully-customisable to your data and team needs. With advanced data management, easy reporting and extensive connectivity, loan processing has never been easier.

- Make your credit process smarter

- Securely analyse and store client data

- Get all the information needed to make the right loan approval decisions

- Stay efficient and make clients happy

Careers with BFC

We are Hiring!

BFC brings together forward-thinking minds from various backgrounds that have the drive to build workable, high-quality solutions.

Check out our most recent openings:

BFC is a proud member of: